Getting a Real Estate Loan…

For the Buyer: Getting Your Loan

Millions of Americans are applying for or refinancing mortgages, yet they have no idea how the loan process works. It’s frustrating to undertake the largest financial transaction of your life when you’re in the dark about what happens behind the scenes. Clients are usually extremely grateful when we explain about loans and escrow.

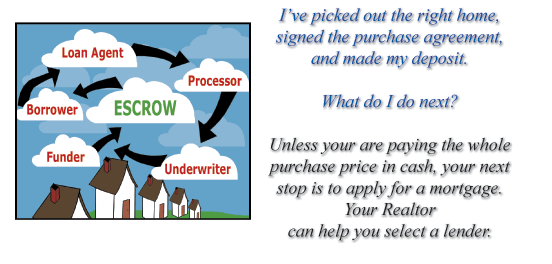

Chronological Overview of the Loan Process.Let start by identifying the players. The stars are (in order of appearance):

• BORROWER

• LOAN AGENT

• LOAN PROCESSOR

• UNDERWRITER

• ESCROW HOLDER

They are backed up by supporting actors, such as appraisers and credit bureaus.

The Borrower

You, the borrower, are the most important player. You start the whole thing with your request for a loan. You supply a loan application and a host of other documents to the LOAN AGENT, including verification of income, expenses, assets, and credit history.

The Loan Agent

The loan agent may be a representative of the lender or an independent broker, Lender’s representative acquaint you with the programs offered by their employer; independent brokers can offer you plans from many lender. In either case, the loan agent handles your loan request, and is your main (sometimes only) contact with the lender. After helping you select a lender and a mortgage plan, the loan agent forwards your paperwork to the LOAN PROCESSOR at the lending institution.